Revenue-Based Financing Secrets Revealed: What Your Banker Doesn't Want You to Know About Flexible Repayment

- Angel Palomero

- Jan 7

- 5 min read

By Van Gothreaux

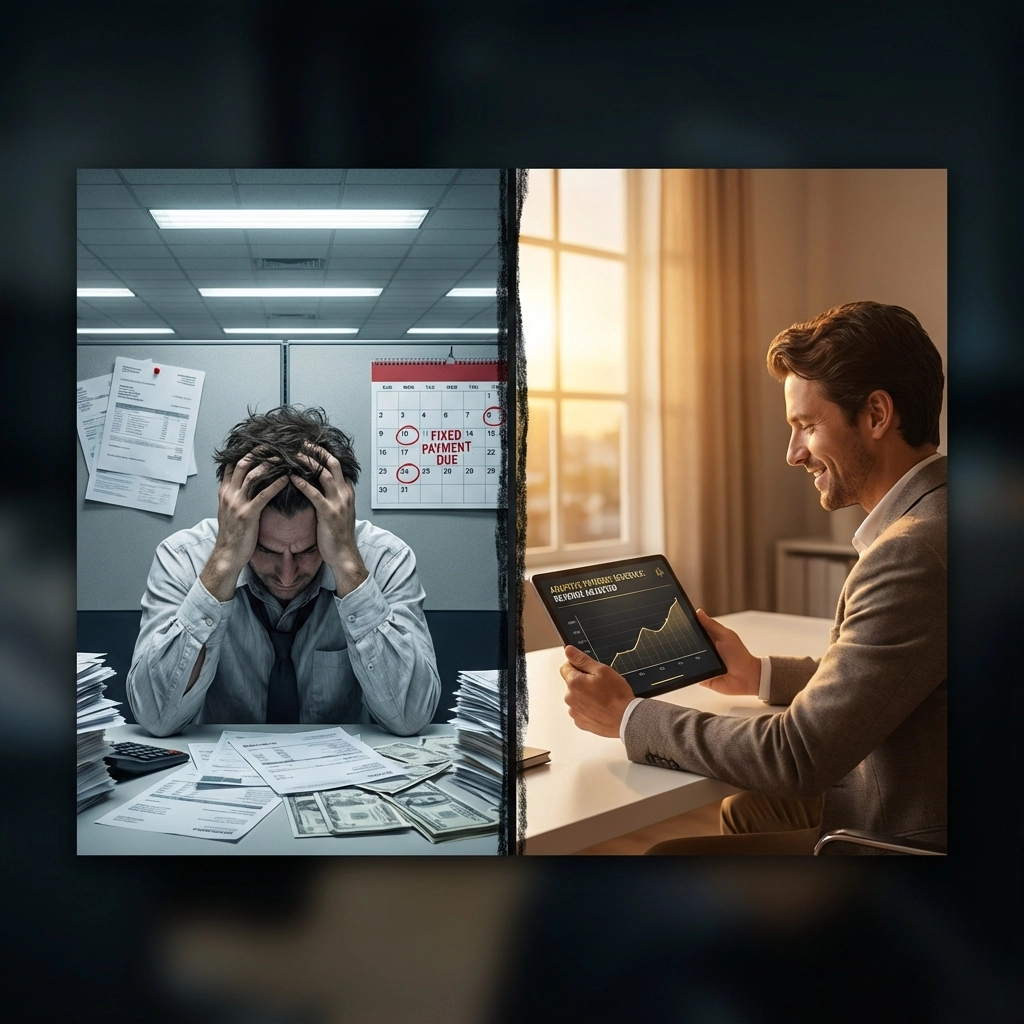

Traditional banks operate on a simple model: fixed monthly payments, regardless of how your business performs. But there's a financing structure that adapts to your revenue fluctuations, protects you during slow months, and accelerates wealth building when times are good. Revenue-based financing (RBF) represents a fundamental shift in how businesses access and repay capital: yet most bankers won't tell you about its strategic advantages.

What Revenue-Based Financing Actually Is

Revenue-based financing replaces the rigid structure of traditional loans with a flexible repayment system tied directly to your business performance. Instead of committing to fixed monthly payments that strain your cash flow during lean periods, you repay a predetermined percentage of your monthly revenue: typically between 3% and 8%: until you reach a specific repayment cap.

Here's how the mechanics work: If you secure $100,000 through RBF with a 5% revenue share and a 1.3x repayment cap, you'll pay 5% of your monthly revenue until you've repaid $130,000 total. During a $50,000 revenue month, you pay $2,500. If revenue drops to $20,000, your payment automatically adjusts to $1,000. This flexibility creates a built-in safety net that traditional fixed-payment loans cannot provide.

The initial funding amount typically ranges from 80% to 120% of your average monthly revenue, with repayment caps generally falling between 1.2x and 1.5x the original funding amount. This structure provides predictability on total costs while maintaining operational flexibility.

The Hidden Benefits Your Banker Won't Emphasize

Ownership Protection and Control Retention

Unlike equity financing, RBF allows you to retain 100% ownership and control of your business. You don't negotiate away decision-making power or future profits to investors. This non-dilutive structure preserves your ability to build long-term wealth through complete business ownership.

Cash Flow Optimization During Market Volatility

Traditional loans demand consistent payments regardless of economic conditions. RBF automatically adjusts to market fluctuations, protecting your cash flow when revenue declines and accelerating repayment when business thrives. This adaptive structure can be a game-changer for businesses navigating seasonal variations or economic uncertainty.

Faster Access to Growth Capital

RBF providers typically process applications faster than traditional banks, often requiring no collateral or personal guarantees. This speed advantage enables you to capitalize on time-sensitive opportunities that drive wealth creation: whether that's inventory purchases, marketing campaigns, or strategic acquisitions.

Alignment with Business Performance

Your repayment schedule naturally aligns with your ability to pay. Strong revenue months result in higher payments that accelerate debt retirement, while challenging periods automatically reduce payment obligations. This alignment removes the cash flow stress that can derail business growth and wealth accumulation.

Understanding the True Cost Structure

While RBF offers operational advantages, you must understand its cost implications. RBF typically carries higher effective costs than traditional loans when calculated over time. A 1.25x to 1.5x repayment cap might seem straightforward, but for rapidly growing businesses, these payments can accumulate quickly.

Consider this example: A business securing $50,000 with a 1.4x cap will repay $70,000 total. If strong revenue growth means this repayment occurs over 10 months instead of 18, the effective annual cost increases significantly compared to a traditional loan's fixed interest rate.

However, this higher cost often proves worthwhile when you consider the preserved cash flow flexibility and eliminated risk of payment defaults during revenue downturns. The key is ensuring your business can generate sufficient returns on the deployed capital to justify the premium.

Strategic Applications for Wealth Building

Seasonal Business Optimization

RBF excels for businesses with predictable seasonal patterns. Retail companies, tourism operators, and agricultural enterprises can secure funding for peak season preparation without the burden of high fixed payments during off-seasons. This structure allows you to reinvest more profits during strong periods while maintaining financial stability year-round.

Growth Acceleration Opportunities

When you identify high-return opportunities: new market expansion, equipment purchases, or strategic hires: RBF provides rapid access to capital without the lengthy approval processes of traditional lending. The flexible repayment structure ensures these growth investments don't create unsustainable payment obligations that could limit future opportunities.

Technology and E-commerce Applications

SaaS companies, e-commerce businesses, and media companies with variable revenue streams find particular value in RBF. The financing structure accommodates the natural fluctuations inherent in these business models while providing capital for customer acquisition, product development, and market expansion initiatives.

Key Distinctions from Alternative Financing

Merchant Cash Advances vs. Revenue-Based Financing

While both offer flexible repayment, merchant cash advances typically cost more and repay exclusively from credit card sales. RBF considers your total revenue stream, providing greater flexibility and often better terms for businesses with diverse revenue sources.

Traditional Lines of Credit Comparison

Lines of credit offer usage-based flexibility but require strong credit profiles and often personal guarantees. RBF focuses on revenue performance rather than credit history, making it accessible for newer businesses or those with limited collateral.

Equipment Financing Integration

Unlike equipment loans tied to specific assets, RBF provides unrestricted working capital that you can deploy strategically across multiple growth initiatives. This flexibility empowers better capital allocation decisions that maximize wealth creation.

Qualifying and Structuring RBF Successfully

Revenue Requirements and Documentation

Most RBF providers require minimum monthly revenue of $10,000 to $25,000, with at least six months of operating history. Prepare detailed revenue documentation, including bank statements, accounting records, and sales reports. Consistent revenue trends strengthen your negotiating position for better terms.

Optimizing Terms and Structure

Factor rates, repayment percentages, and caps are often negotiable based on your business performance and growth projections. Strong businesses with predictable revenue can secure more favorable terms. Present comprehensive financial projections that demonstrate your ability to service the debt while maintaining growth momentum.

Integration with Overall Financial Strategy

Position RBF as part of a broader wealth-building strategy. Use the flexible structure to smooth cash flow irregularities while pursuing high-return opportunities. Monitor your effective cost of capital across all financing sources to ensure optimal capital allocation decisions.

Making the Strategic Decision

Revenue-based financing works best for businesses prioritizing operational flexibility over minimizing capital costs. If your business experiences revenue variability, operates in seasonal markets, or pursues rapid growth opportunities, the adaptive repayment structure can provide significant strategic value despite higher costs.

Traditional bank financing may offer lower rates, but RBF delivers something more valuable: alignment between your payment obligations and your ability to pay. This alignment reduces financial stress, preserves cash flow during challenging periods, and enables aggressive growth during strong performance cycles.

The decision ultimately depends on your specific circumstances and growth objectives. Businesses with stable, predictable revenue might benefit more from traditional fixed-rate financing. However, companies navigating market volatility, seasonal patterns, or rapid expansion often find RBF's flexibility justifies the premium.

At Capco Capital LLC, we help business owners evaluate all financing options to determine the optimal capital structure for long-term wealth building. Our expertise in alternative financing ensures you access the right funding solution at the right time, maximizing your business's growth potential while protecting your financial stability.

Revenue-based financing represents more than just an alternative to bank loans: it's a strategic tool that aligns your financing with your business performance, creating opportunities for sustainable wealth creation while managing risk effectively.